Home Warranty Insurance Cost Things To Know Before You Get This

Table of Contents3 Simple Techniques For Home Warranty Insurance CostFacts About Home Warranty Insurance Cost UncoveredHow Home Warranty Insurance Cost can Save You Time, Stress, and Money.Some Known Questions About Home Warranty Insurance Cost.

A house service warranty can be acquired at any type of time and also does not require to be component of a home sale. Bottom line: Is a home warranty worth it?

If a thing is more than two years old, it's probably no much longer under a basic guarantee. Compare the price of repairing or replacing your products with the expense of a house guarantee plan. To determine just how much you might conserve, make a checklist of your devices and systems. Consist of exactly how old they are, if they're still under service warranty from the maker and also their present condition.

The difference between the price of repair services and replacements and the cost of a strategy is the amount of money you can potentially save.If you purchase a house service warranty, you ought to know upfront which house systems and devices you wish to include in order to decrease the possibilities of spending for coverage you don't require or won't utilize.

Home Warranty Insurance Cost Fundamentals Explained

Before you acquire a residence guarantee, take into consideration just how comfy you are with the answers to these inquiries. Even if your devices aren't new, they might still be under guarantee if you made the purchase with a debt card.

For instance, many American Express cards amount to 24 months of protection (to a producer's warranty of 2 to five years) on things you buy with it. 2. How much will this guarantee cost? The solution depends on the type of strategy you get and the supplier you pick.

Rates might additionally vary depending on where you live. The American Residence Guard website, as an example, states a strategy that covers most major home appliances runs regarding $480 each year for a residence in central Ohio; one that also includes the house's electrical and also pipes systems costs close to $600. By comparison, a home owner in Westchester, N.Y., may pay $900 to cover significant appliances and $1,020 to consist of electric and plumbing.

If you have an issue with a home appliance or system, even one that's covered, you'll have to make a copayment when the professional comes in to do the work. Those fees range from $60 to $125 relying on the work that needs to be done, according to the plans we examined.

Some Of Home Warranty Insurance Cost

Hutt says see this here that most of the grievances that the BBB obtains regarding residence service warranties stem from the fact that consumers don't comprehend the insurance coverage their plans offer. When we examined home warranty plans, we located that some plans will cover your fridge yet not the icemaker that comes with it.

Occasionally, if your device breaks under particular conditions, it will not be covered. An oven, for example, may not be covered if it quits working while in self-clean mode or if it's page damaged by a power surge, according to the plans we took a look at. Exactly how you look after your home appliances may also matter.

Some Known Details About Home Warranty Insurance Cost

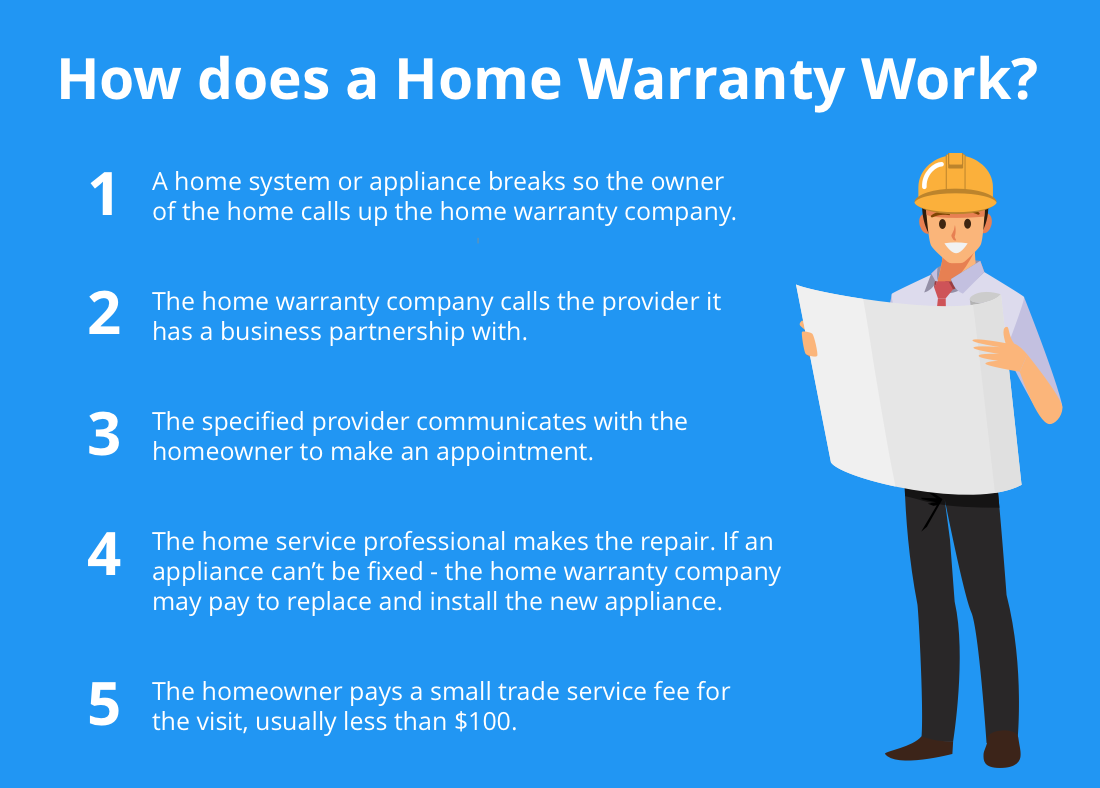

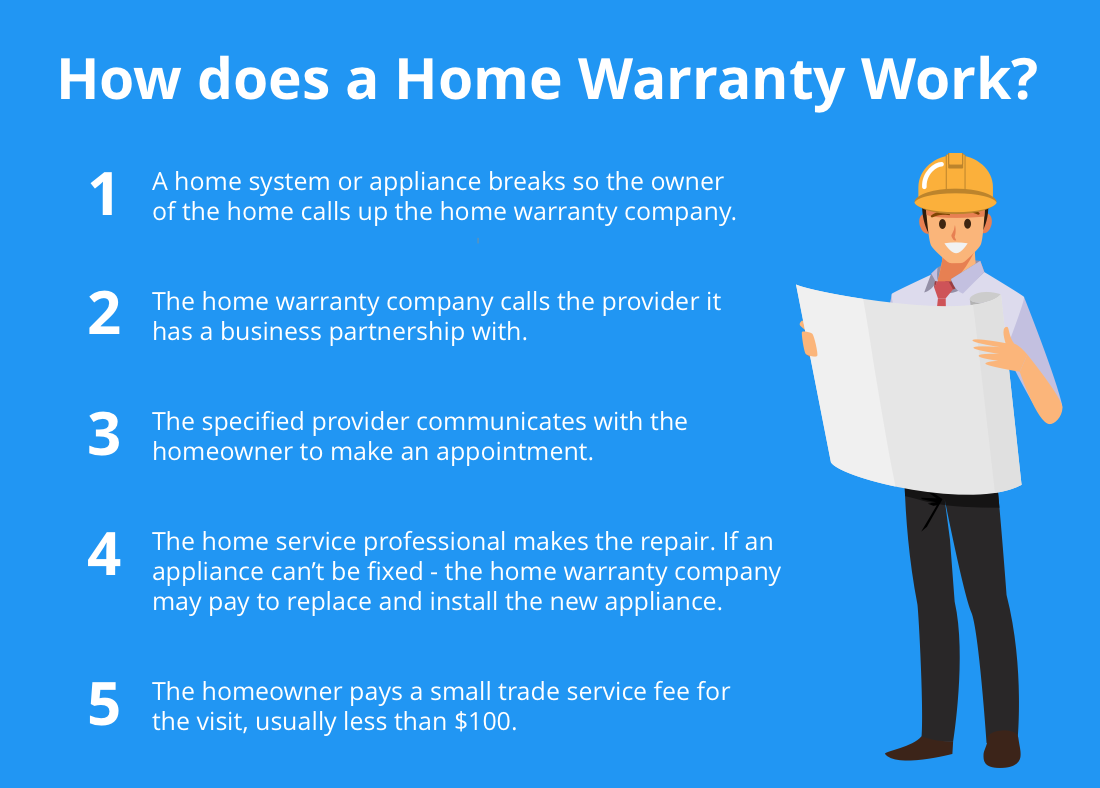

What are residence service warranty firms? House warranty companies market residence warranties, frequently when a house is sold. The pop over to these guys warranty acts somewhat like insurance to ensure that if something significant breaks down, the expense of repair or replacement is covered. This can cover things such as the furnace, hot water heater, kitchen area appliances, or roof.

House service warranty business, subsequently, agreement with services to handle the telephone calls - home warranty insurance cost. Because these firms "arrange" for job, they have to be accredited. Licensing for home service warranty firms Unless they are currently accredited as a basic specialist, these companies have to get a certificate from the Building and construction Contractors Board to operate as a residence services professional.

If you are professional Make sure the house warranty firm is accredited. If you accept work from any type of unlicensed home guarantee firm, you could be breaking the legislation.